45+ how is mortgage interest deducted from taxes

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

How Much Is The Debt Service On External Debt Compared To Tax Revenue In Your Country Quora

Web The mortgage interest deduction is an itemized tax deduction that subtracts interest paid on any loan used to build purchase or renovate a residence from.

. Taxes Can Be Complex. Web So the total Interest that is 1000000 5 50000 will be deducted from the total personal income of Mr. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

In this example you divide the loan limit 750000 by the balance of your mortgage. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. So lets say that you paid 10000 in mortgage interest.

Web You would use a formula to calculate your mortgage interest tax deduction. Web The bottom line is that mortgage expenses are only tax-deductible if you itemize your taxes rather than taking the standard deduction. TaxAct has a deduction maximizer to help find other potential deductions.

Homeowners who bought houses before. Lets say you paid 10000 in mortgage interest and are. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web The mortgage interest deduction is a tax deduction you can take for mortgage interest paid on the first 1 million of mortgage debt during that tax year. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Taxes Can Be Complex. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

X and then tax will be charged on the remaining balance. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more. Web Most homeowners can deduct all of their mortgage interest. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Ad See how income withholdings deductions credits impact your tax refund or owed amount. And lets say you also paid. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

However higher limitations 1 million 500000 if married. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

And even then the rules. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. If you are single or married and.

Interest Only Mortgage Qualification Calculator Freeandclear

How To Pay Little To No Taxes For The Rest Of Your Life

Home Mortgage Interest Overview How It Works Qualifications

Public Attitudes To A Wealth Tax The Importance Of Capacity To Pay Rowlingson 2021 Fiscal Studies Wiley Online Library

Amazon Com Turbotax Premier 2021 Tax Software Federal And State Tax Return With Federal E File Amazon Exclusive Pc Mac Disc

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction Bankrate

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

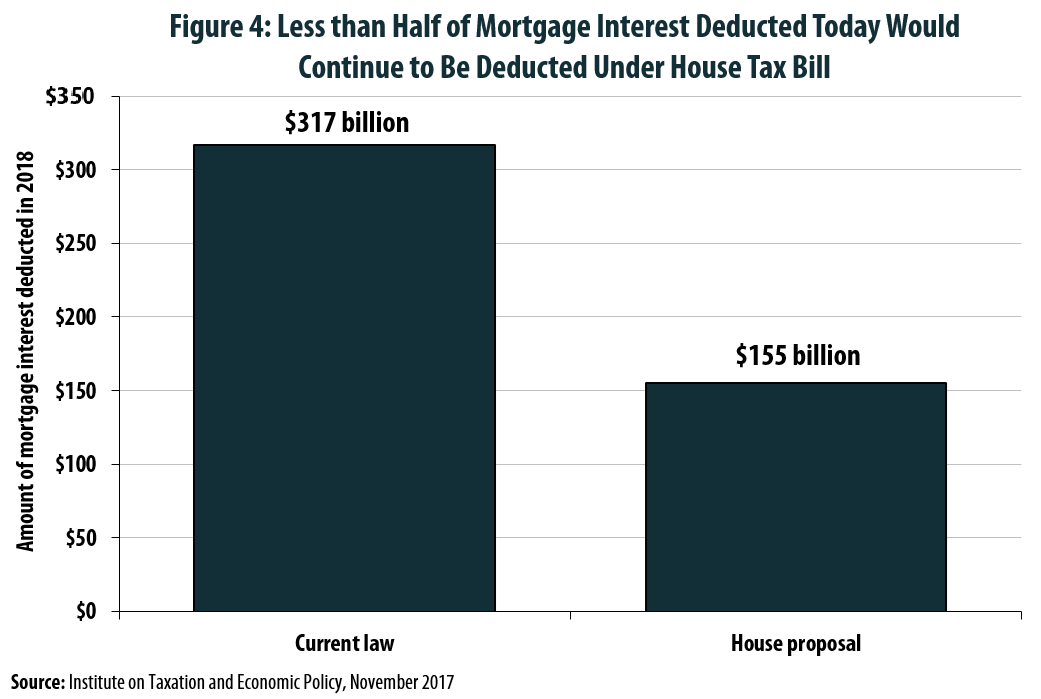

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Calculating The Home Mortgage Interest Deduction Hmid

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Reforms Incentives And Flexibilization Five Essays On Retirement

How The Mortgage Tax Deduction Works Freeandclear